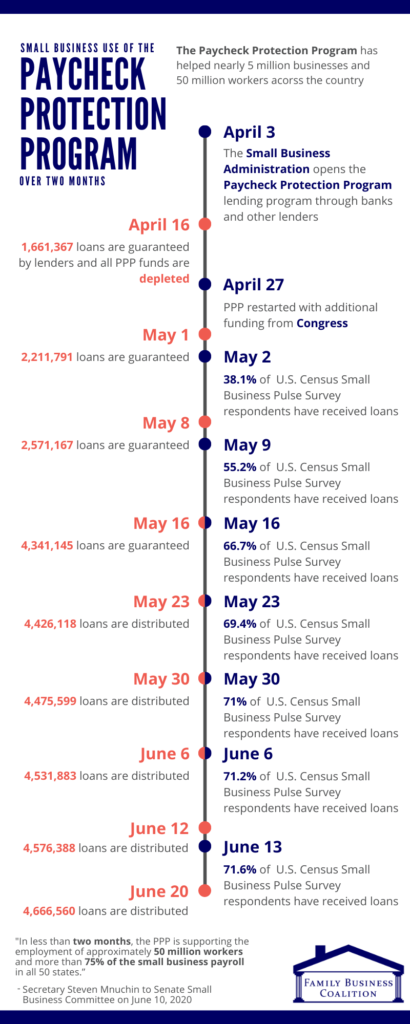

As part of the Family Business Coalition’s (FBC) mission to protect family businesses, FBC began looking into the success of the Paycheck Protection Program. After passage of the CARES Act, our team helped a number of multi-generational family businesses, across a broad group of industries, understand the ins and outs of the newly created Paycheck Protection Program, including the accompanying Treasury guidance. FBC strongly supports the PPP loan program which has helped almost 5 small million businesses cover payroll and business expenses during the COVID-19 crisis.

In less than two months, the PPP is supporting the employment of approximately 50 million workers and more than 75% of the small business payroll in all 50 states.

Secretary Steven Mnuchin to Senate Small Business Committee on June 10, 2020

Many businesses seeking assistance had no problem working with their lender of choice to receive PPP support. Other small businesses had a more difficult time connecting with outside lenders, especially in cases where their local lending institutions weren’t participating in the program. Given that feedback, our team analyzed the latest available data on the PPP program and produced infographics breaking down the successes and failures of the program. These infographics break down the current data on small businesses receiving PPP loans and which lenders were most helpful to America’s small businesses.

Success of the Paycheck Protection Program

Timeline of lenders distributing PPP funds

Comparing PPP loans distributed by community banks and small credit unions

The Family Business Coalition (FBC) is a diverse coalition of small business associations, representing a wide range of industries, and family owned businesses across the country. FBC advocates for a simpler more predictable tax code for America’s family businesses. One of FBC’s principal goals is to help family businesses successfully pass to the next generation of ownership. For more information please e-mail FBC Executive Director Alex Ayers at: alex[@]familybusinesscoalition.org